In Switzerland, tickets for international aviation enjoy fiscal exemptions from three different taxes that could otherwise apply to them. Without these indirect subsidies, tickets would be at least 10% more expensive.

Domestic flights in this small country are rare and short. Additionally, some exemptions extend to domestic aviation too. As a consequence, most aviation in Switzerland ends up benefiting from these tax breaks.

The three taxes

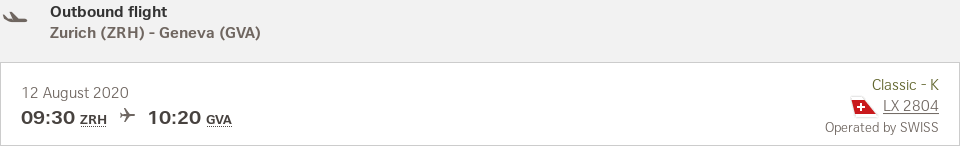

The value added tax (VAT) applies to domestic flights within Switzerland to the regular rate of 7.7%. As the example below shows, it covers at least the fare proper and some charges.

The petroleum tax, that applies to domestic some domestic flights, is CHF 739.50 per 1000 L kerosene [The webpage by the Swiss Federal Custom Administration is available in German, external confirmation that “Flugpetrol” is Kerosene].

The CO₂-levy, CHF 96 per metric ton, covers fossil heating and process fuels but exempts motor fuels, although it is meant to incentivize reductions of greenhouse emissions.

Example ZRH-JFK with Swiss

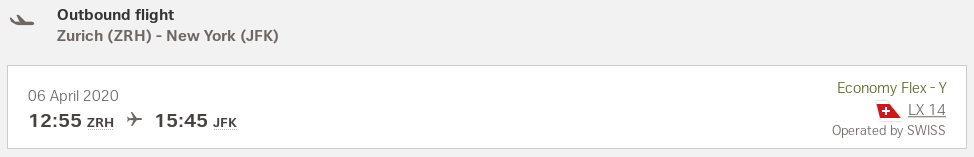

This flight from Zurich to New York with Swiss in economy class, if booked on March 6, 2020, would have costed CHF 1’628.25.

If the VAT applied to all items but the fees and taxes levied in the USA, the taxable price would be CHF 1594.

The ICAO Carbon Emissions Calculator estimates for this flight CO₂-emissions of 333.9 kg per passenger. Their methodology assumes that burning a kg of aviation fuel emits 3.16 kg of CO₂. Thus their estimation of fuel consumption per passenger for this flight is 105.7 kg. The density of kerosene is 0.8 kg/L, hence the corresponding fuel consumption is 132.1 L (in other words, burning 0.396 L of kerosene emits 1 kg of CO₂).

Applying the rates cited above gives the hypothetical amount of three taxes as shown in the table below. Assuming airlines would just charge all taxes to the customers, their sum represents the increase in ticket prices if aviation were to lose these tax exemptions.

The same applies for business class, for which ICAO and others estimate fuel consumption as twice as much as in economy.

| economy | business | |

| price | 1628.25 | 7062.25 |

| taxable | 1594.00 | 7028.00 |

| VAT | 122.74 | 541.16 |

| CO₂ (kg) | 333.90 | 667.7 |

| kerosene (L) | 132.1 | 264.1 |

| petroleum tax | 97.67 | 195.32 |

| CO₂-levy | 32.05 | 64.10 |

| Total taxes | 252.47 | 800.57 |

| Taxation | 15.5% | 11.3% |

Without the tax exemptions, the economy flight would have costed CHF 1880 instead of CHF 1628, that is, 15.5% more.

Other examples

Following the same method, here two other examples with other destinations.

| route | class | price | increase if taxed |

| Zurich – New York | economy | 1628.25 | 15.5% |

| business | 7062.25 | 11.3% | |

| Zurich – Singapore | economy | 1085.00 | 24.4% |

| business | 4574.00 | 15.6% | |

| Geneva – Beijing | economy | 1438.70 | 16.7% |

| business | 3116.70 | 16.6% |

Additional sources: